The State of UK Fabrication & Manufacturing 2018–19

Outlook

In these stormy days of uncertainty it's time to consider where we are at right now, disruption forces retrospect and prediction – how to keep going. Brexit is, has and will continue to ruffle feathers through to 29th March 2019 and beyond. But a very plausible silver lining emerges for British engineering and manufacturing with a return to making on home soil, and we're good at it too, world-class good. In larger batches we're more expensive but our R&D is par excellence (e.g. defence, aerospace, electronics, Formula 1) with the evolution of smart factories and Industry 4.0, we're on to something. One can argue the rest of the world is too but the UK is particularly interesting for foreign investment because of our financial, legal and employment infrastructure, unique in or out and nearby Europe, this is attractive.

Figures

PWC audited 1.3% GDP growth for 2018, predict 1.6% GDP growth for 2019 and 1.75% in to the 2020's. We built as many cars as we did in our 1970's heyday, we export three quarters, plus 3 million engines were built in the UK and over half exported. Aston Martin are building a new car and plant in Wales, TVR are nearly in production albeit Brussels insisting that their Ebbw Vale factory refurbishment must go to European tender. McLaren are seriously ramping up product range and production. Airbus threatens to leave but Boeing opens it's first European plant here in the UK, they spent £1.8 billion with tier 1 suppliers in the UK in 2017, and so are consolidating their operations here. Bombardier to build record number of trains in 2019. Rolls Royce (had a record breaking 2018) and Bentley both announce supply chain worries but they have to be 'Made in Great Britain', so surely BMW and VW Germany will find a way to maintain the brands' integrity and their investment.

Yes, Jaguar Land Rover have moved Discovery production to Slovakia, but they're investing hundreds of millions of pounds in manufacturing reorganisation including at the Solihull plant for future hybrid and electric car production. The move away from diesel, economic slowdown in China and Brexit will lie behind Honda and Nissan's partial departure of some model productions. Electric vehicle manufacturing presents potential seismic changes to production technique so manufacturers are looking at a new script, the way we move on the road is evolving. The UK government is investing £400billion in transport projects of all kinds through to 2020/1, that's a lot.

"The UK’s approach to vehicle production, with its focus on light-weighting and innovation in advanced materials, is an ideal model for electric car production globally. It’s no secret that some of the world’s best vehicle engineers are clustered around Silverstone. When coupled with a government receptive to our ambition and goals, we couldn’t find a better home to establish our pilot production facility.” Uniti One CEO Lewis Horne.

And UK electric motor firm Equipmake are ready to become world's top supplier, they designed the KERS systems for Formula 1 and World Endurance Championship cars. They discovered and patented a new way to cool the magnets that allows them to deliver higher continuous power than others and in most applications will be smaller, higher-revving and use less materials.

Currently 19% of the UK total work force is employed in the engineering sector making 23% (£1.23 trillion) of the UK's total turnover. 27% of registered enterprises are in the engineering sector, manufacturing contributing £6.7 trillion to the global economy. Right now we are approximately 20,000 graduate level and 56,000 Level 3 engineers short in an industry growing at 6% per annum. By 2024 the UK is going to need 120,000–200,000 people with Level 3+ engineering skills per year to keep up with demand. The UK is currently the world’s eighth largest industrial nation, and at current growth could be in the top five by 2021, but how much Brexit might impact remains to be seen.

Forecast

Companies are worried about what is going to happen but all say they'll plough on regardless because no one knows until it happens, "stay calm and carry on" ™. Not knowing usually disrupts the money markets but the Pound is still marginally up on the Euro (since 2017), and predictions are — price of things to go up, which may reduce some sales, supply shortens (supply chain border friction) but demand may increase, makers will look to new manufacturing solutions and to cut costs to be competitively priced. Re-shoring and near-shoring will ever be future trends for supply chains, cost and time-to-delivery seeks to be shorter, quicker, speed effectively aiding flexibility.

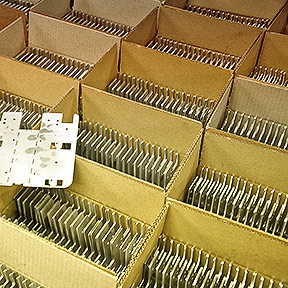

At Glenmore Hane

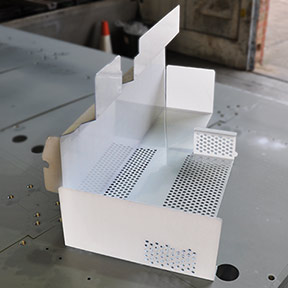

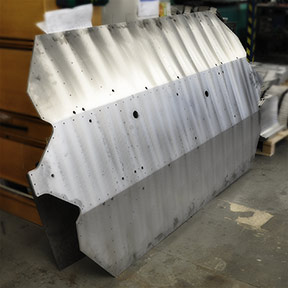

We have invested in another bigger sheet metal bending and folding machine, that folds sheet plastics too. Increased power and run double shifts in the sheet metal finishing and anodising department here in Slough. We are on fire production-wise and hitting all time records, actively seeking sheet metal fabricators and investing in plant equipment. We are increasing our production quantity, as our sheet metal fabrication quality is speaking for itself, looking at the order books.

About us

Glenmore Hane remains committed to provide fine-limit sheet metal services by highly experienced and knowledgeable staff who can advise on test-proven production techniques as well as environmentally sound solutions. Specifically positioned on the M4 corridor with fantastic links across the UK. Glenmore Hane design, fabricate and finish high quality sheet metal components, fully qualified to work to ISO9001:2015 standards ensuring reliable and quality controlled production output on demand and on time. So if you need precision sheet-metal protoypes and or short run sheet metal fabrication – either send it direct through our website enquiry page, or contact Mark Hall on 01753 528884